Private residential construction spending showed a modest uptick in June, rising 0.1% and breaking a six-month streak of declines, according to new U.S. Census Construction Spending data. The increase was led by small gains in single-family construction and home improvement projects, though overall residential spending remains well below last year’s levels as the housing market continues to grapple with economic headwinds.

Compared with June 2024, private residential construction spending is still down 5.3%, reflecting the broader challenges posed by elevated mortgage rates and persistent tariff concerns affecting building material costs.

Single-family construction, the sector most sensitive to borrowing costs, inched up 0.1% in June. The improvement aligns with the July NAHB/Wells Fargo Housing Market Index (HMI), which showed slightly improved builder sentiment. However, on a year-over-year basis, single-family spending is still down 2.1%.

Remodeling and home improvement spending also registered a slight monthly increase of 0.1%, though it is down a steep 7.6% from last year. This slowdown suggests that many homeowners are delaying or scaling back renovation projects as financing costs remain high.

Multifamily construction continues to lose momentum. Spending in this category fell 0.4% in June, extending a trend of declines that began in mid-2023. Compared with June 2024, multifamily spending has dropped 9.4%, reflecting reduced developer activity amid higher construction costs, tighter lending conditions, and slower rent growth in some markets.

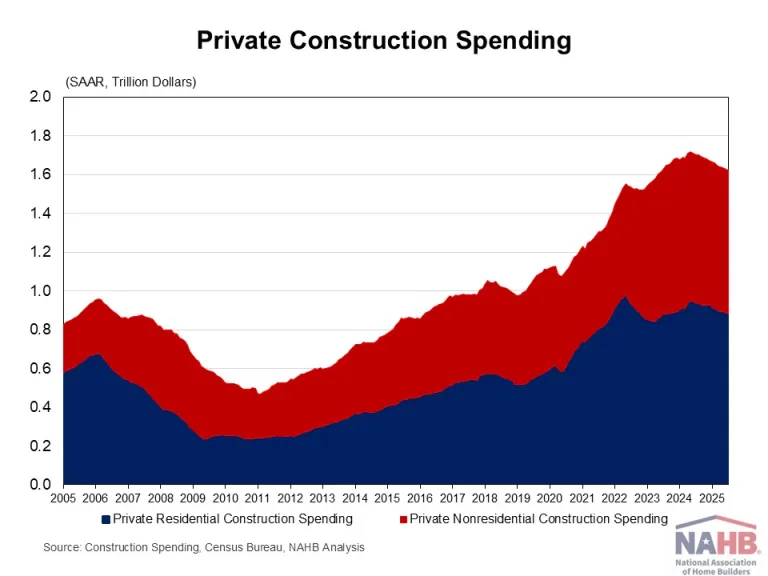

The NAHB construction spending index illustrates how growth in single-family and multifamily construction has steadily slowed since mid-2023. The combination of high interest rates and tariffs on building materials has weighed heavily on new housing starts and limited the ability of developers to bring new supply to market.

The slowdown isn’t confined to housing. Private nonresidential construction spending was down 3.7% year-over-year, with the decline led by a sharp $16 billion drop in commercial construction and a $12.2 billion decrease in manufacturing-related spending. These pullbacks reflect growing caution among developers and businesses facing uncertain economic conditions.

While June’s modest increase marks a small turning point, housing economists caution that sustained growth in private residential construction will depend on easing interest rates and greater certainty around material costs. Without relief, both single-family builders and multifamily developers are likely to remain cautious heading into the second half of 2025.

Originally reported by National Association Of Home Builders in IBM Journal.