LINCOLN, Neb. — The latest Sandhills Global market reports suggest that inventory levels in the used construction equipment market are beginning to stabilize after months of sharp declines. The September 2025 data, covering construction machinery, farm equipment, trucks, and trailers across Sandhills platforms, points to a mixed but more balanced landscape for buyers and sellers.

According to the reports, both heavy-duty and medium-duty construction equipment inventories are showing steadier month-to-month changes. While overall values remain under pressure, some categories are leveling out, and others, such as forklifts and telehandlers, continue to climb.

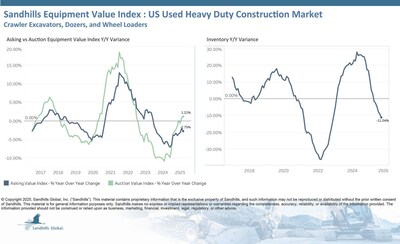

Inventory levels fell 1.72% month-over-month (M/M) and 11.04% year-over-year (YOY) in September. Dozers led monthly declines at 2.33% M/M, while crawler excavators posted the steepest annual drop at 13.78% YOY. Asking values were down 1.22% M/M and 2.75% YOY, while auction values slipped 0.48% M/M but ticked up 1.21% YOY.

Inventory levels rose 1.86% M/M but remained down 8.31% YOY. Mini excavators saw the strongest monthly gains at 4.7%, while loader backhoes dropped nearly 20% YOY. Asking prices fell 1.06% M/M, but auction values were mixed, down 1.78% M/M and up 1.52% YOY.

Inventory showed long-term growth but dipped 1.03% M/M. YOY levels rose slightly, up 0.92%, with rough terrain scissor lifts gaining 18.73% YOY. Asking prices, however, continued to fall, down 1.66% M/M and 8.73% YOY.

One of the strongest growth categories, forklift inventories have now increased for eight consecutive months, jumping 4.95% M/M and 28.92% YOY. Pneumatic-tire forklifts were the standout category, with a 7.42% M/M and 31.69% YOY increase.

Inventory climbed 1.38% M/M and a sharp 19.65% YOY, extending a 31-month upward trend. Asking prices declined slightly (0.45% M/M, 3.63% YOY) and auction values fell 0.82% M/M, 4.19% YOY.

Down 1.88% M/M and 17.98% YOY. Asking and auction values continued downward trends.

Inventory dropped 12.74% YOY. Asking prices decreased YOY, but auction values rose 5.86% YOY.

Inventory showed sideways movement, up 2.49% M/M but down 12.57% YOY. Asking values fell for the sixth consecutive month.

Up 2.5% M/M but down 20.39% YOY. Asking and auction values both trended upward.

Inventory dropped 6.1% M/M and 16.95% YOY. Day cabs showed the largest monthly decline (10.02%), while sleepers saw the biggest annual drop (18.26%). Asking prices fell slightly, down 0.17% M/M and 0.54% YOY.

Inventory declined 4.05% M/M and 16.34% YOY, marking the seventh straight monthly decrease. Reefer trailers fell the most month-to-month, while dry van trailers led annual declines at over 26% YOY.

The Sandhills Equipment Value Index (EVI) remains the key metric for buyers and sellers tracking used equipment market performance. The September report shows that while asking values for many categories are softening, auction values in certain sectors — such as combines and planters — indicate resilience.

Sandhills emphasized that these metrics give buyers and sellers critical insights into supply-and-demand dynamics. The data helps businesses maximize returns on acquisitions, disposals, and fleet management decisions across agriculture, trucking, and construction markets.

“Monitoring the EVI provides valuable foresight,” the report notes, “especially in a market environment where some categories are trending sideways while others continue downward.”

This September snapshot reveals a marketplace in transition. While overall equipment inventories are still below last year’s levels, growth in forklifts and telehandlers suggests operators are preparing for continued demand in logistics, construction, and warehousing — even as prices adjust downward across multiple categories.

Originally reported by Sandhills Global in PR News Wire.